“Oh, that financial problem with that customer just seemed to happen overnight”

Naaahhhh.

That’s generally not a true statement. There are small indicators along the way that demonstrate the financial health of a business. Like all relationships, problems don’t appear at the drop of hat.

So, how can you better understand the financial health of a customer?

The answer? Understand your relationship better.

Put simply, you’ve got to improve your customer relationship management. You need to have a deep understanding of their accounting trends, business quirks and behavioural themes so that you can identify when issues arise and plan accordingly

So what are some signs a customer is in financial distress?

This ain’t no crystal ballin’. These are some simple methods you can apply to your customers’ situations to get a better feel for their situation. The Klugo team advise these methods to anyone involved in enterprise resource planning (ERP).

1. Average days overdue

It’s a simple one, but often overlooked with a more analytical eye. Look at trends over time.

- How many days do they take to pay an invoice?

- How many invoices are in dispute?

- Are they providing reasons for late payments?

When averaged, if these are starting to increase over time, you can assume that they are having cash-flow issues.

The quicker the spike with a debtor, the sooner you may have a problem. It’s a simple formula to understand their financial position.

2. Complain, complain, complain

There’s nothing more enjoyable than taking a customer complaint… yeah, nah!

This is a sneaky tactic by customers, because you may assume the problem lies with your business. But this is a common tactic businesses use when they are financially distressed.

Why? Because it can be a simple way to extend payment by purposely ‘kicking up a stink’ about invoices or other small issues.

Again this is a matter of looking at trends over time. If there is a spike, it’s important to start asking questions to your customer.

3. Days sales outstanding (DSO), an important metric

Whilst this is similar to a late payment, it’s important to understand how this metric is calculated and its significance. In its simplest form, it is the average amount of days it takes to receive payment.

Cash flow is king and vital for running a business. It’s necessary for a business to collect payment as quickly as possible. Why? Because money spent waiting for payment is quite literally dead money.

Listen to the numbers. A high DSO generally means that a company is relying on a credit structure to run a business. This is risky, so it’s important to understand what is a reasonable DSO for your business and try to hold your customers accountable to meet this KPI.

Hindsight, it’s a wonderful thing. But often too late

When we look back on how we lost a customer, there are often the signs above which make us say:

“Ok, that makes sense”.

But that realisation is not helpful. As the cost of saving a customer is often far less expensive than acquiring another.

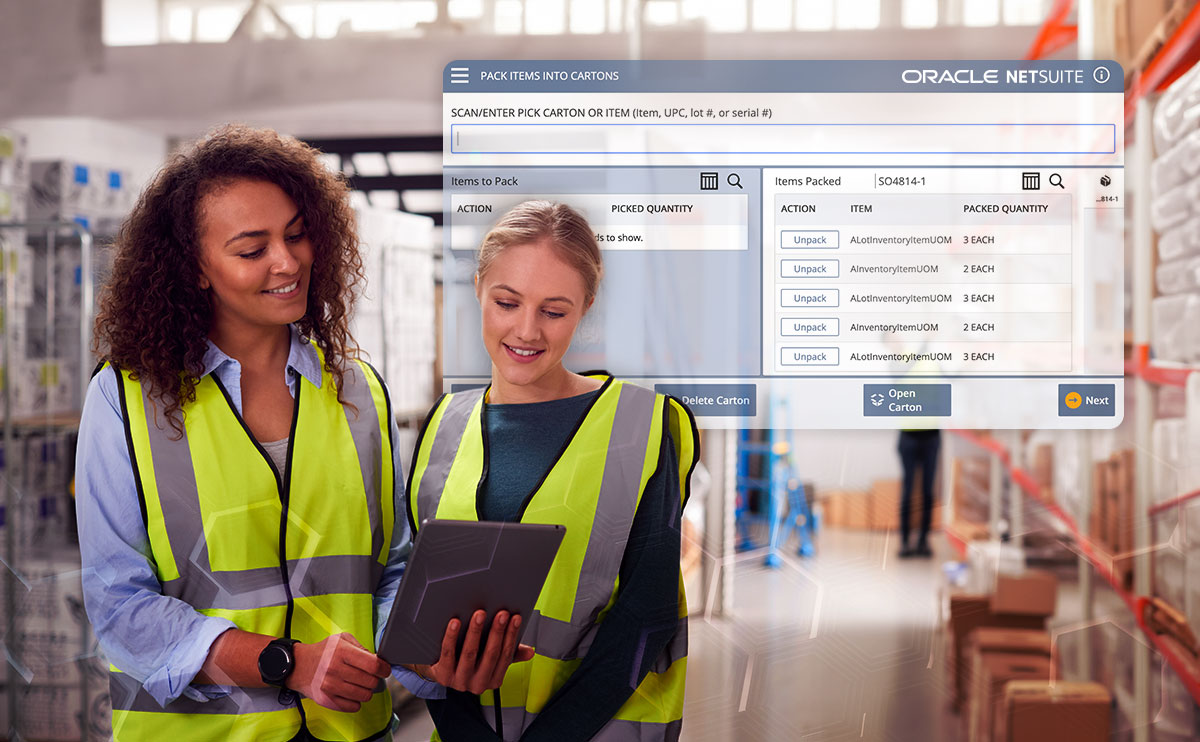

Predicting behaviour is crucial. This comes down to customer relationship management that is intrinsically intertwined with your financial structure. This is why Klugo have chosen NetSuite CRM as its preferred partner. The system makes customer KPI management simple.

It allows for customers to collect insights that mean predicting behaviour is more native and simple than hindsight analysis.

So, how do we intervene with a troublesome debtor/customer?

There are some simple steps you can take to save losing a customer. The goal of this step is to increase the lifetime value of a customer. Think about how you can improve their situation so that you can keep a long-term relationship.

Buy-back stock – Sometimes stock just isn’t moving for customers. If you have the capacity and the ability to move it elsewhere, offering to buy back stock can be an effective way to move resources between your customers whilst keeping everyone happy.

Account holds – This is a tricky one, but if you enter an agreement right from the start where a customer knows that supply will be held if payment is not received within a specific term, they will place more emphasis on their own resource planning.

Upfront payment – This is a neat little process to ensure quick payment (and achieves low DSO) that benefits both customers and your business. Better deals for customers who pay upfront can be a nice deal sweetener on both ends.

CRM, get integrated

Implementing a CRM that is fully integrated with your financials allows you to monitor both the sales and financial health of your customers. You know precisely when KPI’s are overdue or exceeded.

A good customer relationship knowledge through a good NetSuite CRM removes the pressure away from diagnosing an issue post mortem and allows you to predict issues before they arise.

Speak to Klugo today to find out more about getting strategic with your CRM.

About Klugo

NetSuite + NextService

Klugo’s vision is to unlock the full operating potential of our customers to maximise the value of their business. We do this by helping our customers achieve operating excellence using NetSuite + NextService, the world-leading cloud ERP and FSM business platform for small-to-medium-sized businesses.

Need a specialist’s free advice?

Feel free to call an expert in operational excellence today. Find out how cloud-based technology can support and quickly adapt to your growth strategies.