Australian CPI rose by 1.8% over the last quarter, while inflation during the last twelve months has been 6.1%.

Last year $100 in the bank would have earnt you next to no interest. Today, that same $100 is only worth $94. While you technically still have $100 in the bank, the purchasing power of your dollars has diminished as prices have increased. In real terms, this means that your money is worth less than before.

Purchasing Power

Basically, this is the value of currency expressed in terms of the number of goods or services that you can buy for your money. When you are operating a business, if you only have $100 but you need $150 in goods, you must either buy less or borrow the difference. As a consumer, we tend to go without, and instead focus on our fundamental living expenses.

For a business, focusing on the fundamentals looks very different compared to the approach taken by a consumer. Sometimes, we can change suppliers to reduce costs, but in the current environment, with the cost of goods going up across the entire supply chain, we are forced to look at our staffing and overheads to find areas where we can reduce costs as our purchasing power decreases.

Unfortunately, it is so much more complicated than that, as we are also experiencing low unemployment, which puts pressure on wages to retain or replace staff. As a small-to-medium business (SMB), this can feel like a vice as larger companies make public packages to attract candidates while we are experiencing supply cost pressures.

The Cost of Money

Many companies fund working capital through overdrafts or loans. The cost of that money is factored into the over-net profit target and can become a permanent component. The money theory is that utilising finance to buy inventory to sell/make to generate a profit is faster than saving the money in the first place.

It’s the same idea as borrowing to buy a house. If the interest cost is less than the capital growth on the asset, then it is better to borrow to buy now rather than save up over 30 years and pay the total purchase price in cash. When you sell the house, you will be able to realise the capital gains less interest paid on the loan.

This is the same as a business borrowing to buy inventory. In fact, your ability to service a loan increases your overall borrowing power, which in turn increases the business’ ability to meet new demand and grow.

Increasing Interest Rates

Here’s the rub: While inflation is eroding our buying power, the RBA responds by increasing the cost of money. Ultimately, this slows economic activity and reduces supply costs, hence lowering inflation, as well as causing interest rates to stabilise or possibly come down if over-adjusted.

During this ‘are we in a recession yet?’ period, we find ourselves experiencing the worst of both worlds: both increasing cost of supplies and money. We don’t know if we are in recession until the quarterly reporting tells us.

The business confidence index from Roy Morgan Business tells us more about this story. The confidence index has been trending down since April this year. Additionally, according to the Australian Bureau of Statistics, almost a third of employing businesses (31%) are having difficulty finding suitable staff, while 46% of businesses have experienced an increase in their operating expenses.

So, what can a SMB owner do?

The most rewarding aspect of my role at Klugo is that I get to engage with so many business owners and share experiences. While there is no magic wand to be waved, and it is mostly about getting back to fundamentals, it’s good to be reminded of lessons learned and at times forgotten.

Openly communicate

Uncertain times breed fear. Bad news that festers is the proverbial ‘making a mountain out of a molehill’ scenario that we want to avoid. If things are not going well, keep your team informed and solicit help. You will be amazed at how much a struggle shared among your team will bring them together.

This is also true of customers and partners. Letting them know what the issues are and what you are doing about them may also result in them offering you support. There is nothing worse in business than bad news that comes as a surprise.

Measure margin contribution

Factor in the cost of money if you are financing working capital and seek to shorten your day sales outstanding (DSO) while extending payment terms with your suppliers. Improving cash flow will reduce working capital and improve margins.

If you run a service-only business, ensure that your team is fully utilised. When they are not busy, engage customers proactively for value added (even if it is for free) to generate more work. Unlike inventory, a day unbilled can never be recovered.

Increase prices and shorten terms

Ask your customers for improved payment terms also, as the faster you get money to pay down debt, the lower the cost of that money. This is not always possible, however, as your customer is likely experiencing the exact same issues as you. If that’s the case, then rather than requesting shorter terms, you could consider billing more frequently if you currently leave it until the end of the month. Running weekly invoicing will reduce DSO and improve overall cash flow.

Reduce prices and lengthen contract terms

If your customers are in the same boat, facing rising costs across the board, locking in a customer while providing some relief for their own dilemmas may pay significant dividends in future.

Prioritise debt repayment

Consolidate your product or service line

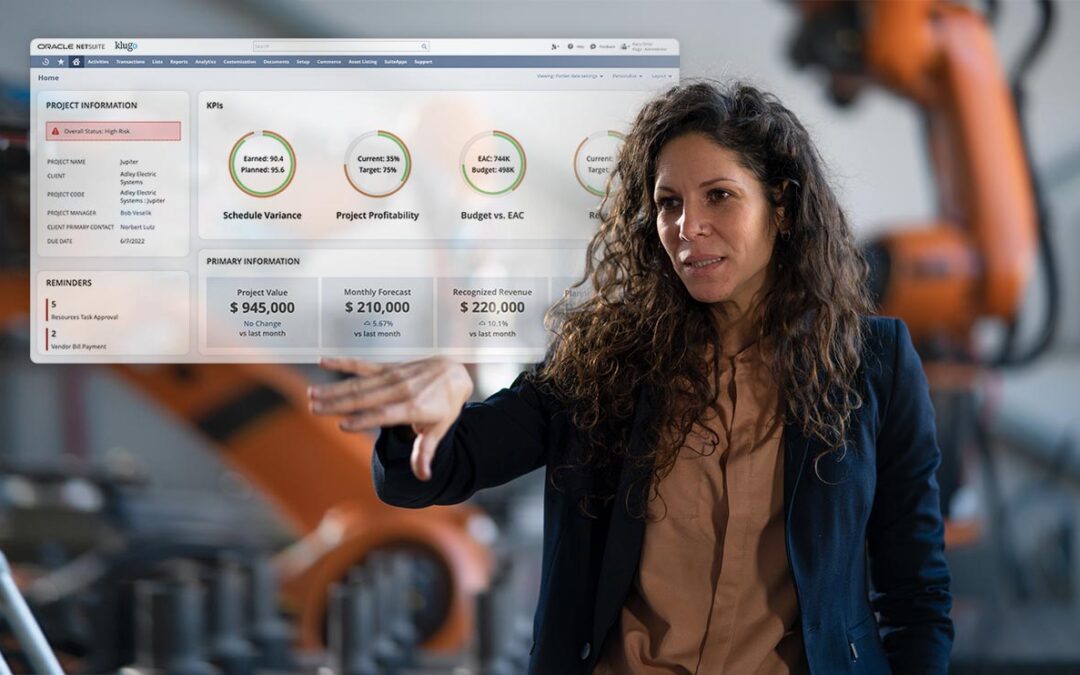

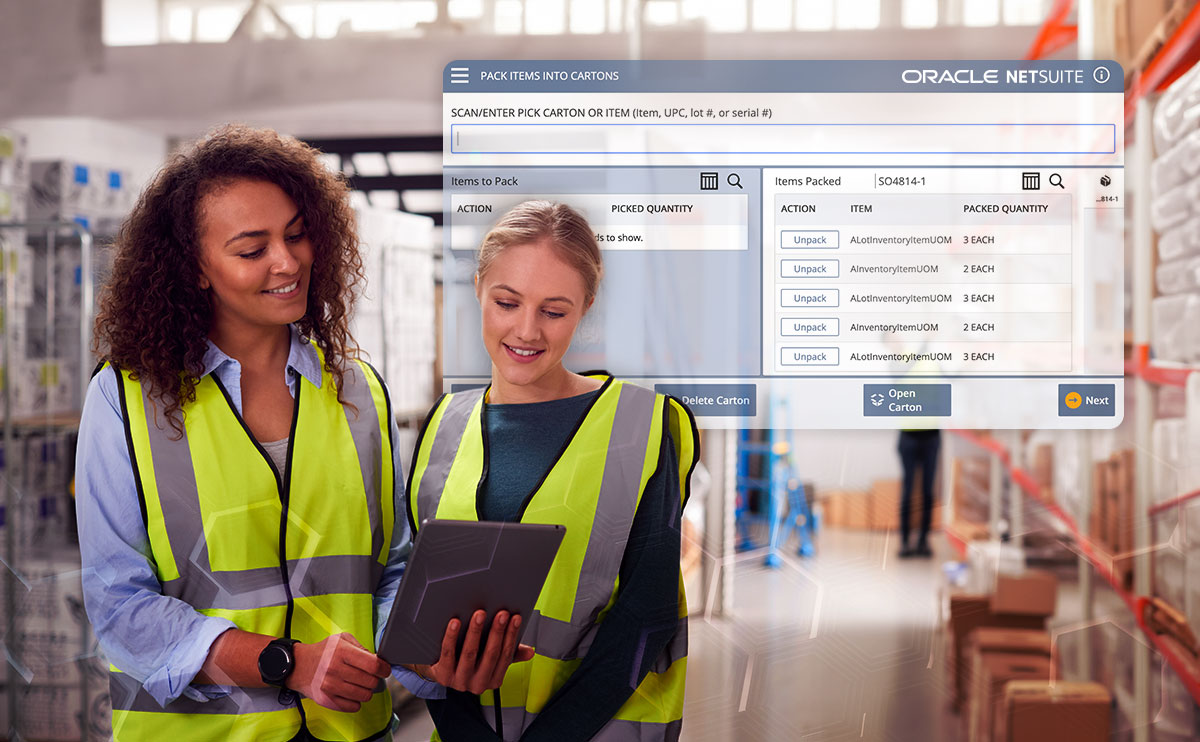

Invest in technology to optimise

A recession knocks out poorly-run businesses, creating opportunities for those that become lean. Now is the time to invest in operations to reduce costs, speed up performance and generate value for your customers and stakeholders.

Conclusion

It can be a real challenge to see things clearly when there is so much negative press and uncertainty. To ensure we have clarity, we need to acknowledge issues early, communicate openly and make lots of little corrections to avoid a big correction later down the track.

Historically, businesses that thrive during a recession go on to grow rapidly during the post-recession rebound, and they see significant growth. This creates a major opportunity to focus on our strengths and cut the rest down to be as lean as possible in order to build up our capability for when the economy stabilises again.

We hope that we’ve provided you with some valuable takeaways from this post. Please follow or subscribe to keep receiving more Klugo briefing posts in future.

About Klugo

NetSuite + NextService

Klugo’s vision is to unlock the full operating potential of our customers to maximise the value of their business. We do this by helping our customers achieve operating excellence using NetSuite + NextService, the world-leading cloud ERP and FSM business platform for small-to-medium-sized businesses.